Limit offer up to 50,000 USD

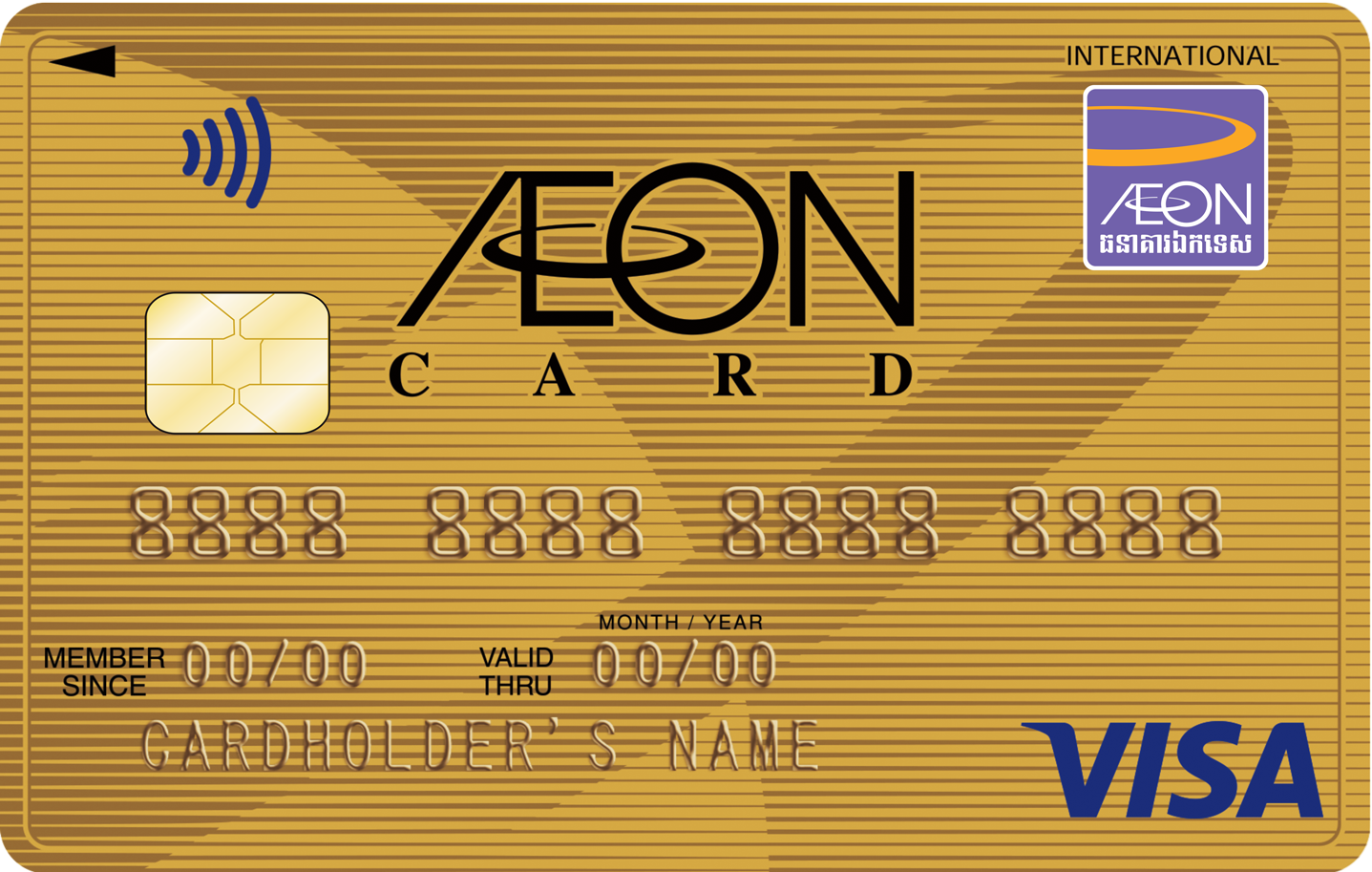

AEON Gold Card “Proof of your success”

Enjoy privileges and prestige rights at your fingertips.

Benefits of AEON Gold Card:

- Special discount from more than 500 Alliance Partner shops in Cambodia

- Get 5% discount on every 20th and 30th of each month at both AEON Cambodia stores and AEON MaxValu Express stores

- Enjoy the comfortable and relaxing AEON Lounge free snack, free drinks and free Wifi

- Enjoy point saving program to redeem for either cash voucher or cashback

- Free application fee

- Cash advance up to 10,000 USD